Trade smarter. Adapt faster. Learn continuously with Elysia.

Elysia brings behavioral AI into your trading world and decode patterns, emotions, and opportunities that traditional analytics miss.

Trade smarter. Adapt faster. Learn continuously with Elysia.

Elysia brings behavioral AI into your trading world and decode patterns, emotions, and opportunities that traditional analytics miss.

MEET ELYSIA AI ASSISTANT

Go beyond just stats;

Get clear context.

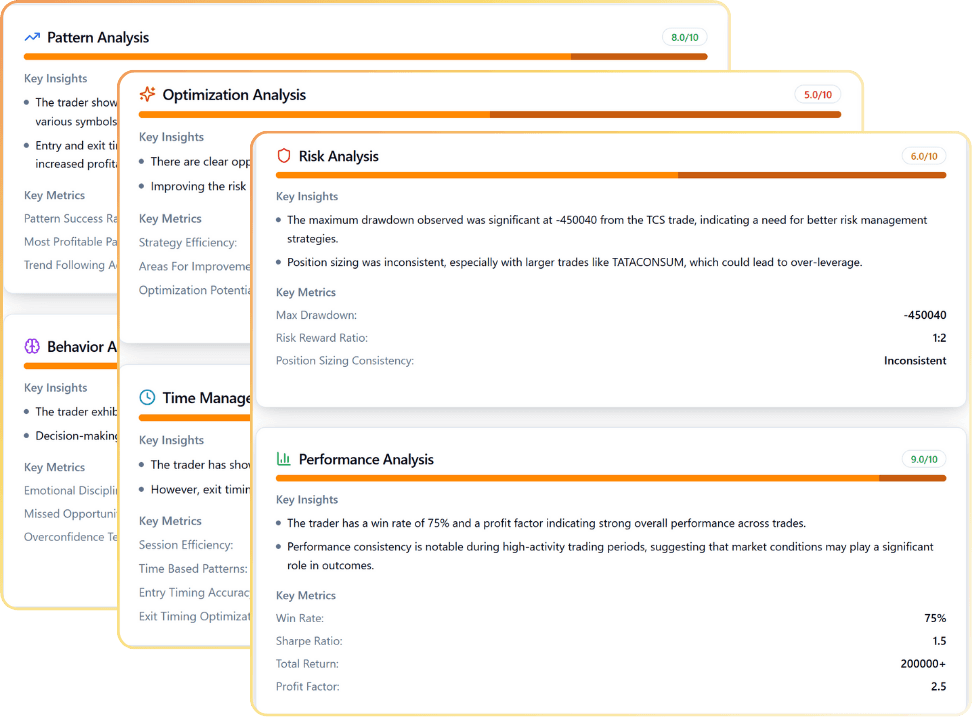

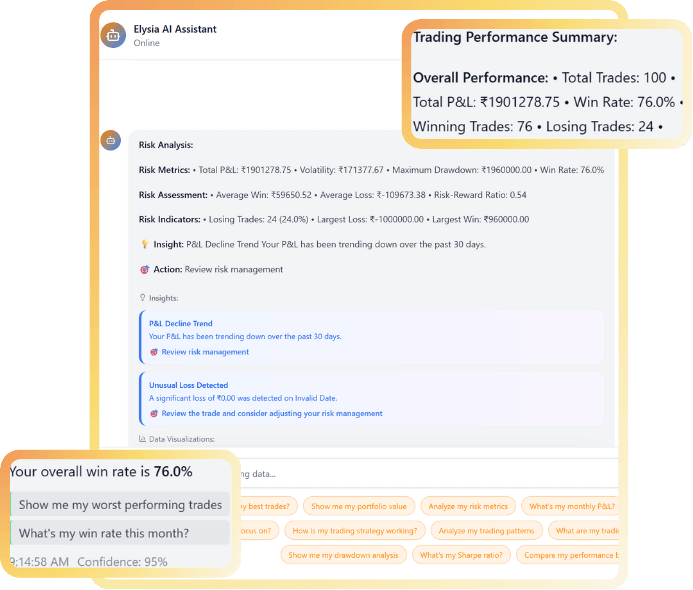

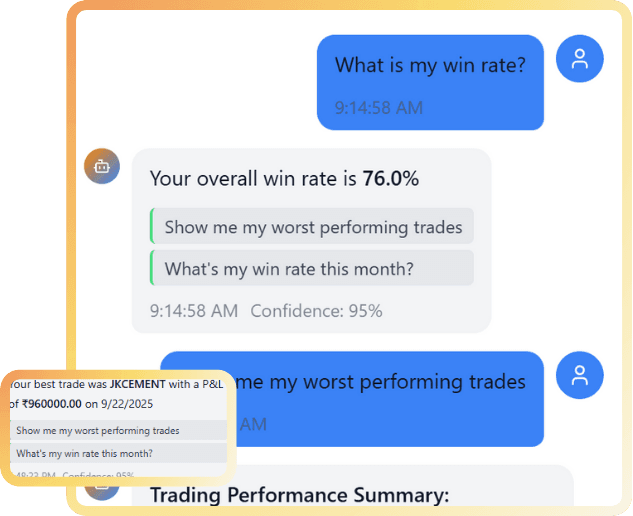

Elysia understands plain English, whether you type or speak your questions.

Elysia adapts to your style, evolves with your patterns, and refines insights to match your progress over time.

See beyond the noise. Our models break down charts, volumes, and trends into clear action points you can trust.

Elysia automatically prepares performance summaries and trade reports in seconds. Track growth, compare results, and visualize data effortlessly without manual spreadsheets.

Elysia identifies recurring patterns, setup tendencies, and timing inefficiencies across trades. Learn what drives success and spot performance habits before they repeat.

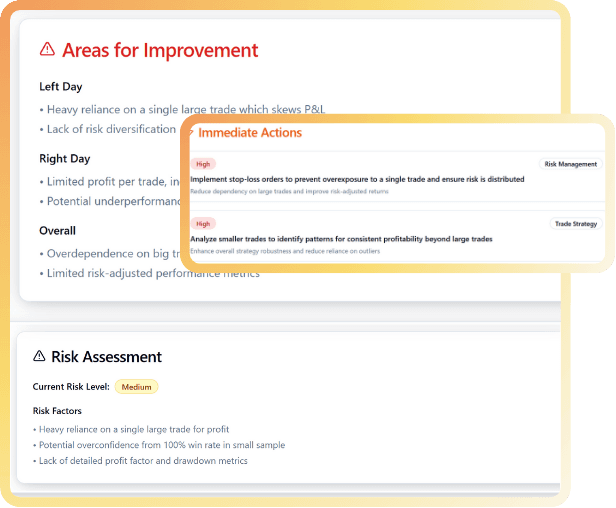

Elysia evaluates drawdowns, volatility, and position sizing to ensure your trades stay aligned with your strategy. Manage capital effectively and trade with controlled confidence.

Elysia understands natural language queries like “Show my best setups” or “Compare last month’s PnL.” Get clear, conversational insights instantly — anytime you ask.

ELYSIA ANALYTICS

Turn raw trading data into

performance clarity

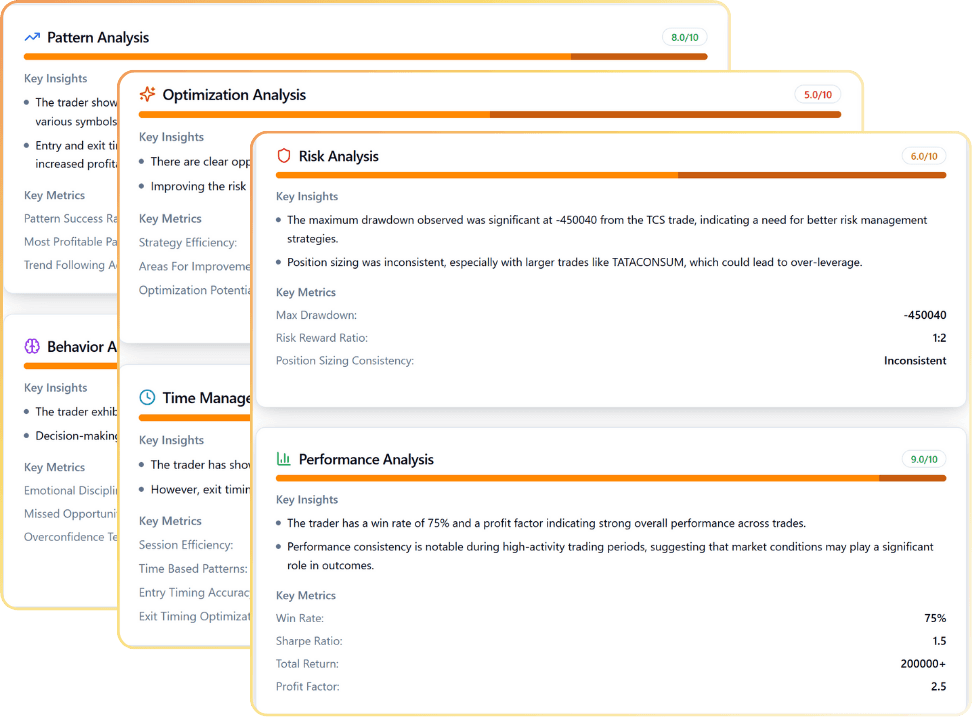

Elysia transforms complex trade logs into clear, data-driven intelligence.

From detailed performance metrics to behavioral insights, every number is analyzed, connected, and visualized, so you can focus on refining, not decoding.

Elysia studies your trade execution, reactions, and timing to detect behavioral biases like revenge trades or early exits. Recognize patterns and make emotionally balanced decisions.

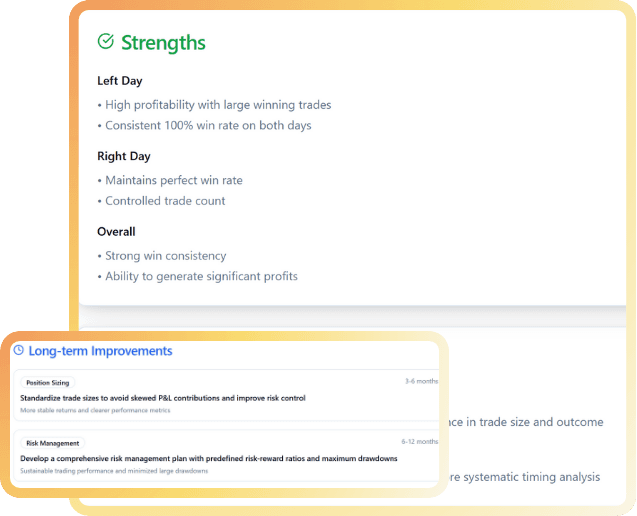

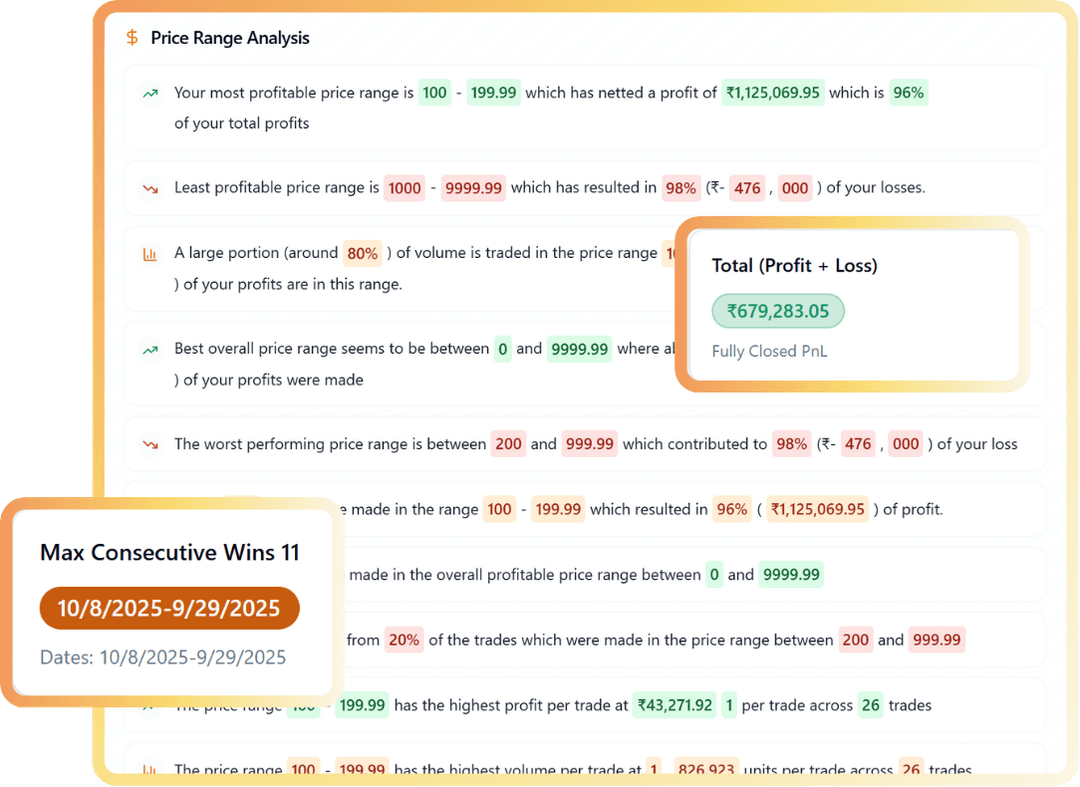

Elysia reviews your trading data to pinpoint what needs refinement — from entry timing to position sizing. Get AI-backed recommendations that turn insights into measurable growth.

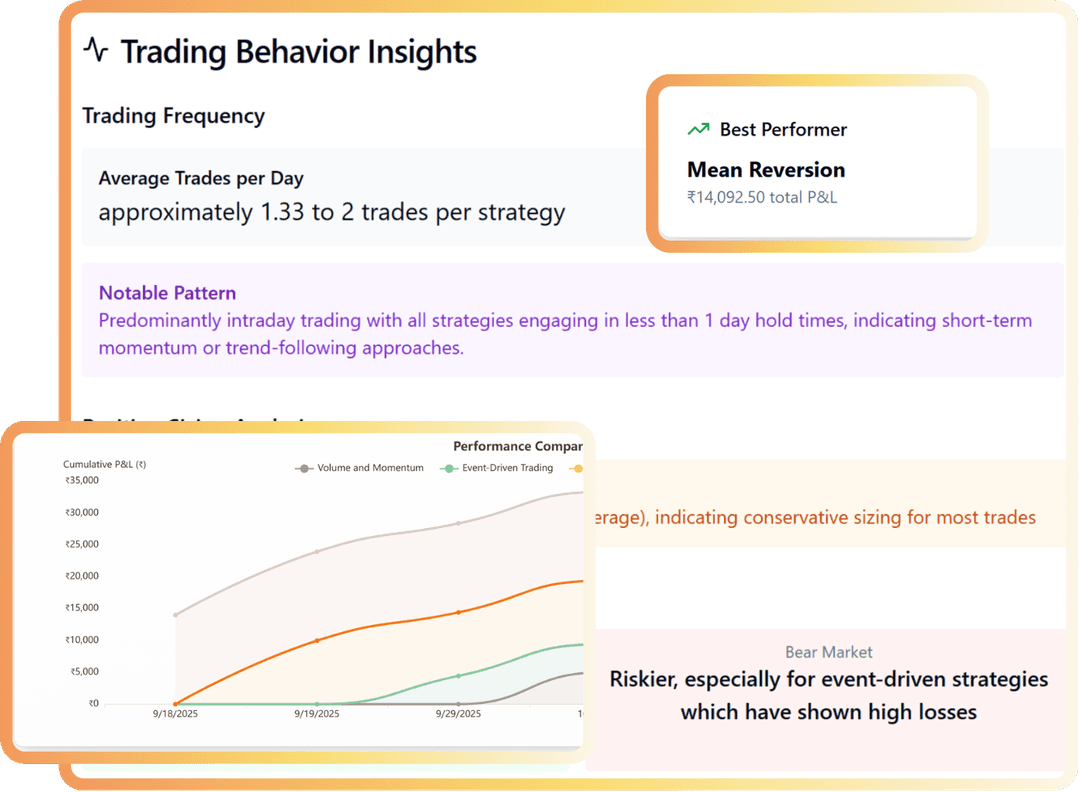

Elysia evaluates your existing strategies across setups and market conditions, revealing which ones work best. Continuously optimize your edge with adaptive AI tuning.

Elysia detects emotional triggers, overconfidence, or hesitation in your journaling and trade data. Stay consistent by aligning mindset with method for long-term discipline.

ELYSIA INSIGHTS

Master timing by understanding

your market rhythm

Elysia interprets complex data across trades, strategies, and

sessions turning subtle shifts in performance and market rhythm into early trading signals.

Elysia consolidates all your strategy outcomes to show high-performing setups, underperformers, and diversification strength — giving you a clear snapshot of your portfolio’s health.

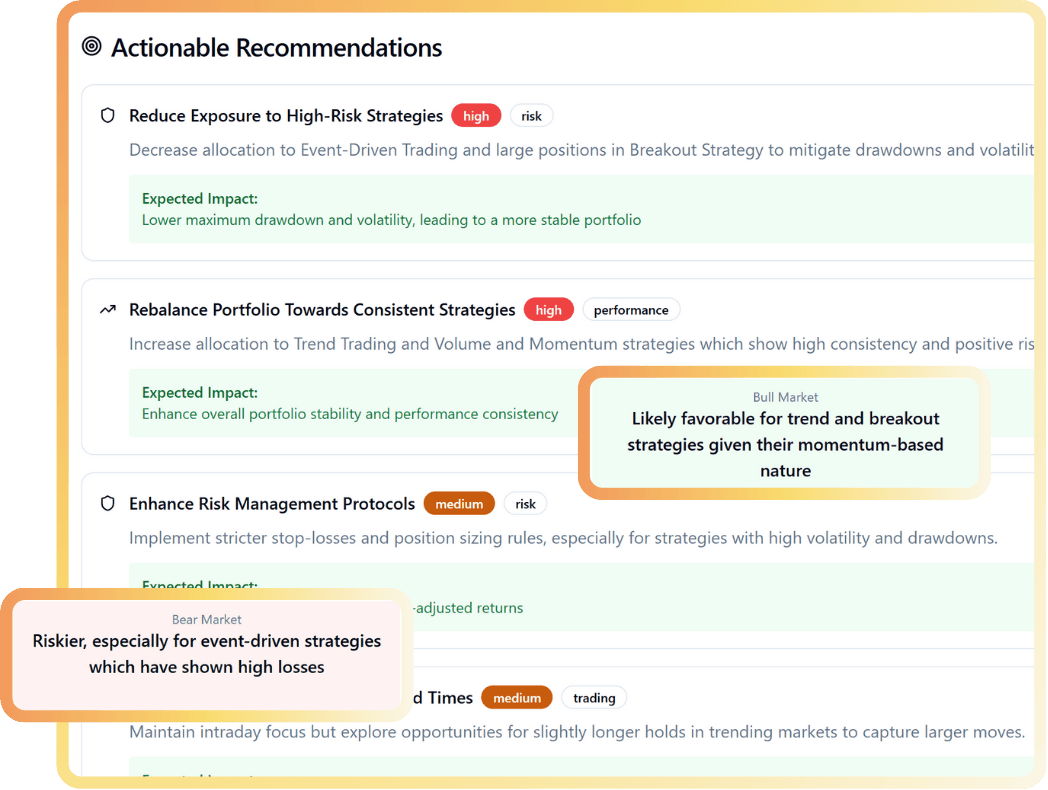

Elysia measures drawdowns, correlation strength, and volatility exposure to highlight potential weak points in your risk management approach before losses escalate.

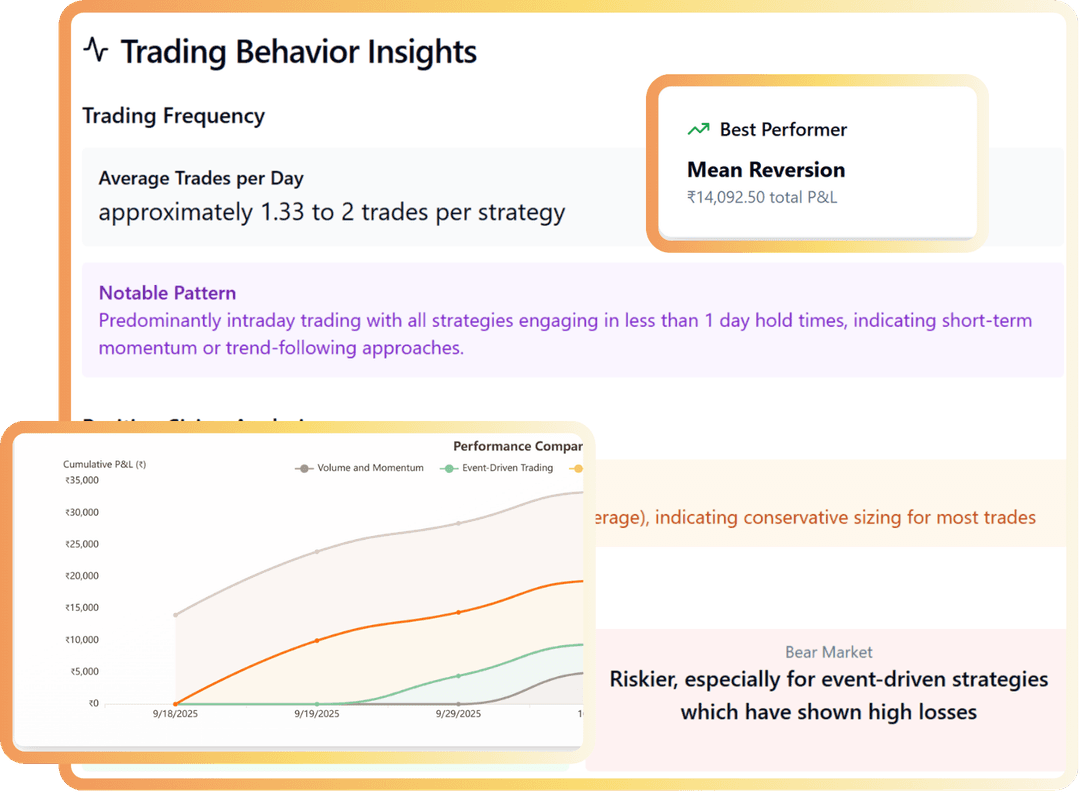

Elysia studies your entry and exit efficiency, measuring missed opportunities and premature exits to fine-tune your timing across sessions.

Elysia compares position sizes against strategy type, risk limits, and market volatility — helping you maintain balance between capital exposure and consistency.

Elysia scores your strategies on accuracy, stability, and profit factor — revealing which approaches perform reliably versus those needing structural improvement.

Elysia evaluates how your strategies correlate, identifying concentration risks and suggesting diversification improvements for smoother equity curves.

Elysia evaluates your time-based performance to highlight which sessions, hours, or volatility windows yield higher returns — helping you optimize daily trading schedules.

Elysia observes how closely you follow your trading plan, detecting impulsive deviations, missed stops, and rule breaks to improve execution discipline.

ELYSIA RECOMMENDATIONS

Personalized trade ideas built

around your style

Elysia learns your trading patterns, risk appetite, and favorite setups delivering personalized,

data-backed recommendations that evolve with your performance.

Elysia analyzes timing windows, trade duration, and market volatility to suggest optimal execution points.

Avoid overexposure and capitalize on strong setups. Elysia adjusts your position size dynamically based on recent performance, volatility, and win–loss stability trends.

Elysia transforms analytical insights into practical steps — guiding you to rebalance, rotate, or refine strategies aligned with current market conditions.

Elysia identifies emotional trades, inconsistent sizing, or revenge patterns — then recommends corrective steps to strengthen your psychology and execution discipline.

Elevate your strategy with AI

that learns you

Elysia continuously monitors your trade data, risk exposure, and decision behavior to uncover hidden inefficiencies and boost performance. It’s like having an AI co-strategist that never stops optimizing your edge.