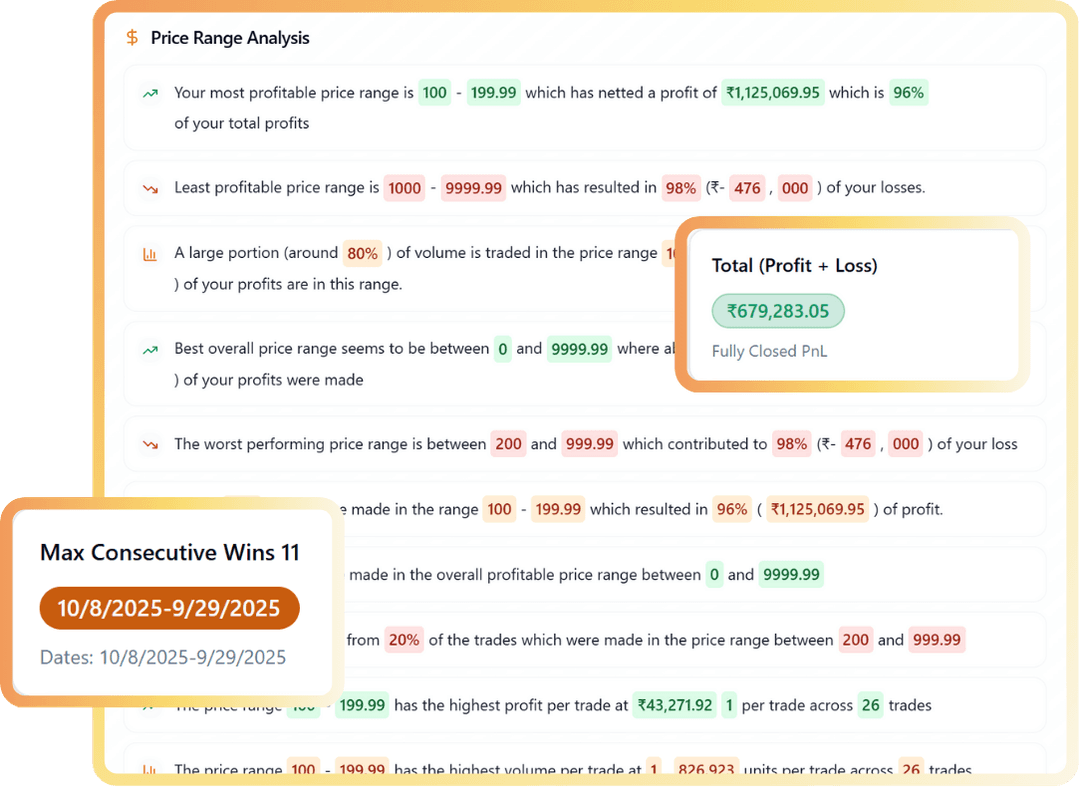

Turn raw reports into refined trading intelligence.

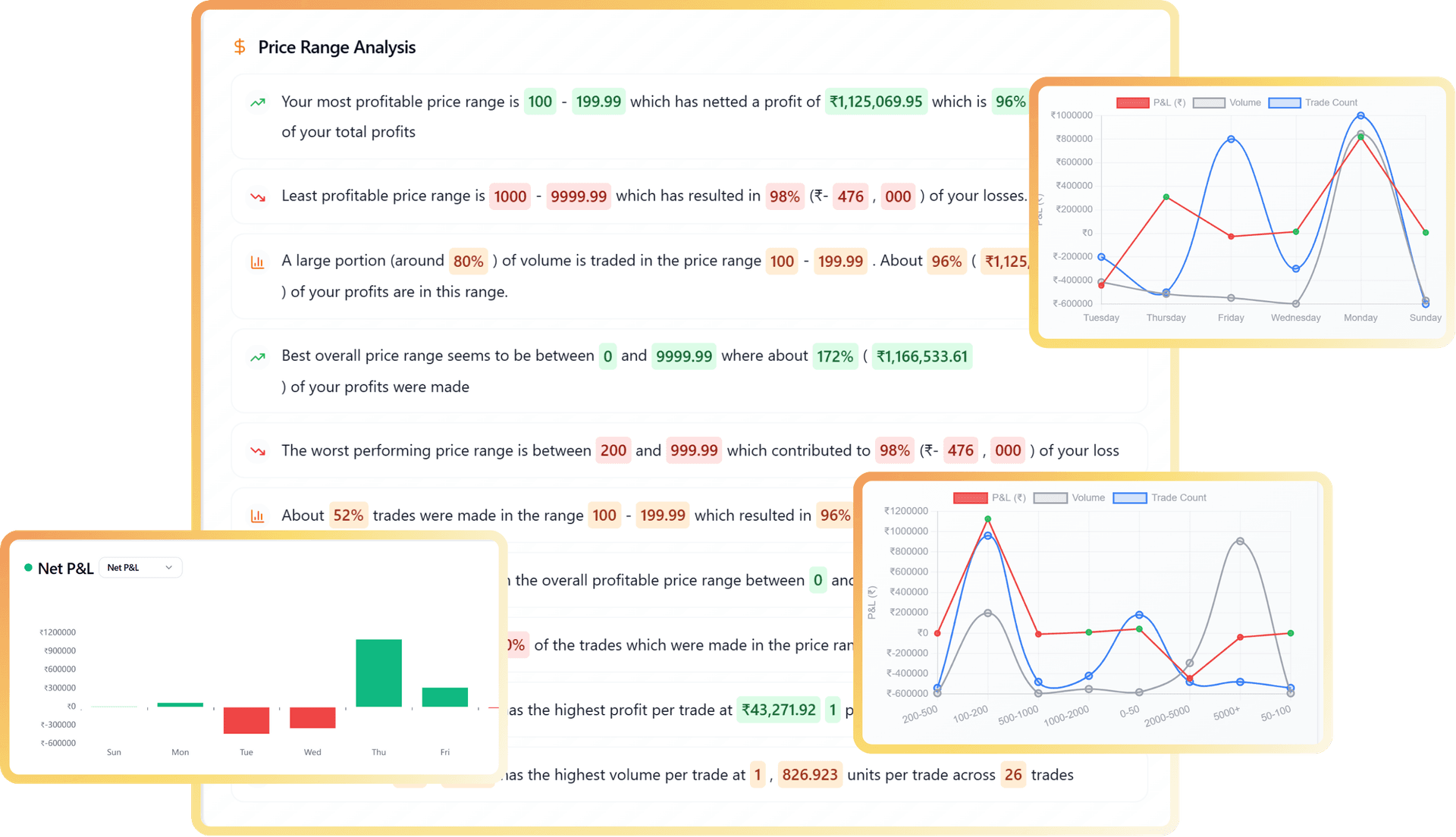

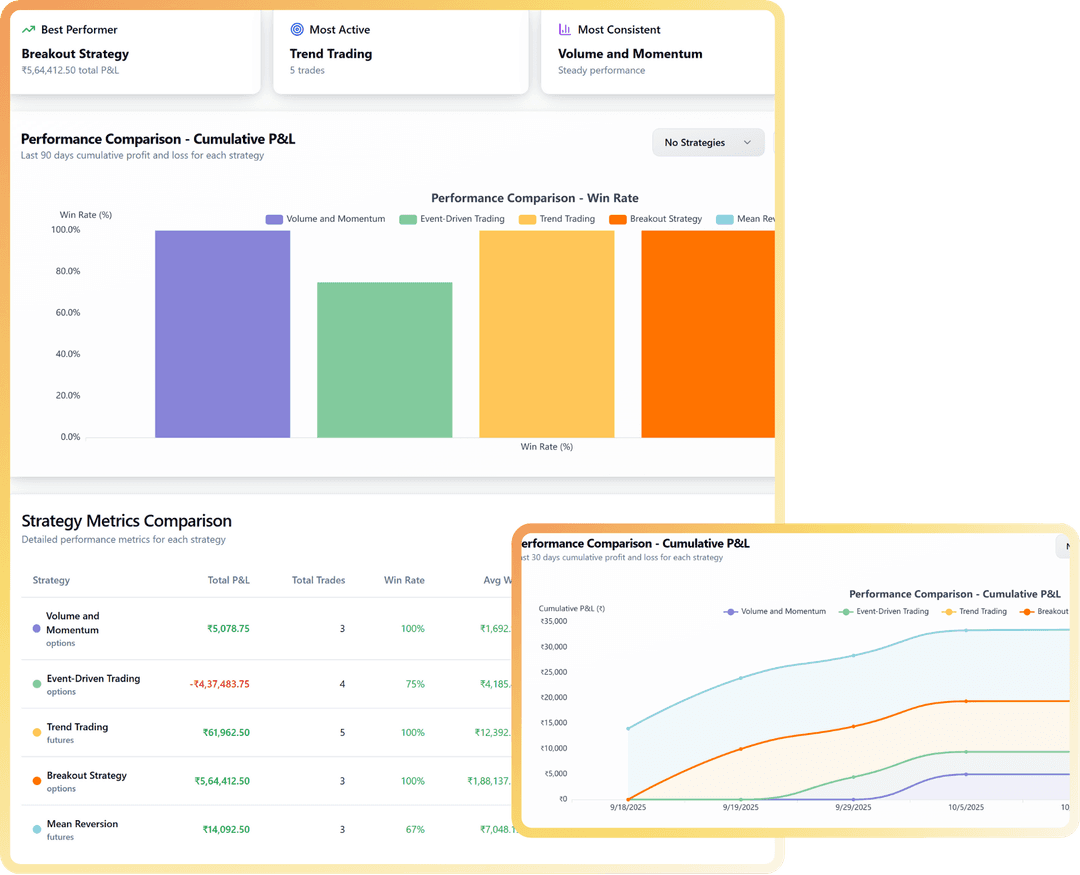

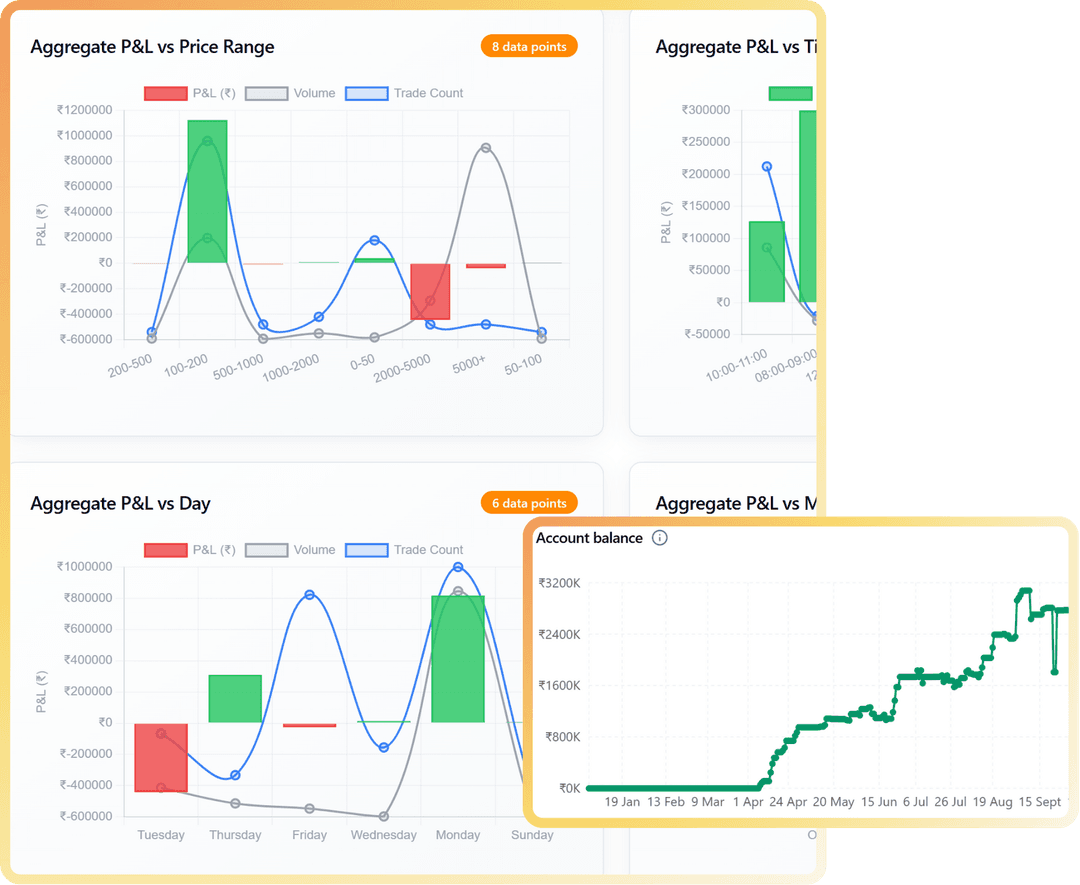

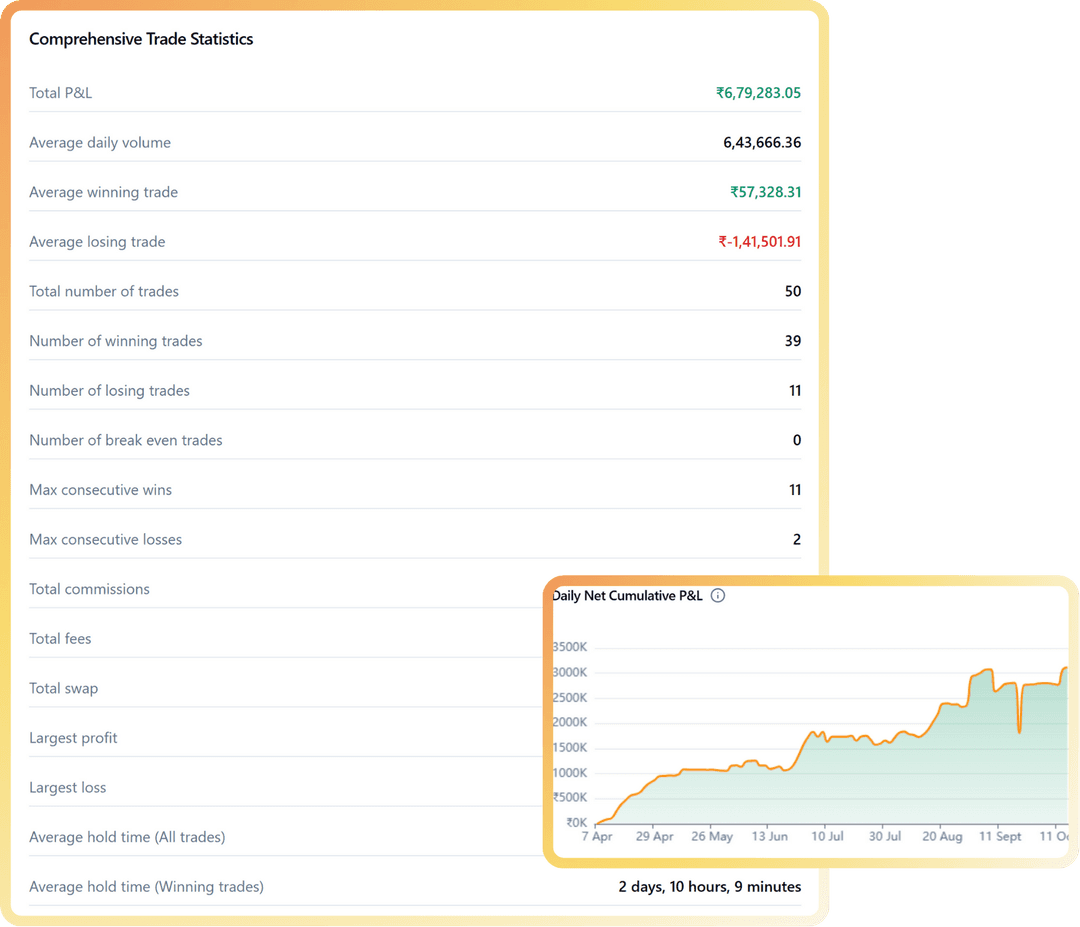

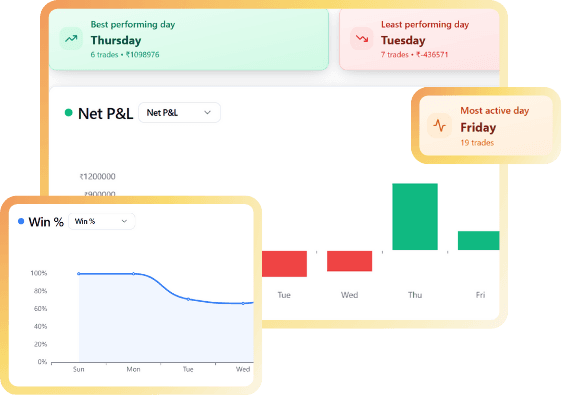

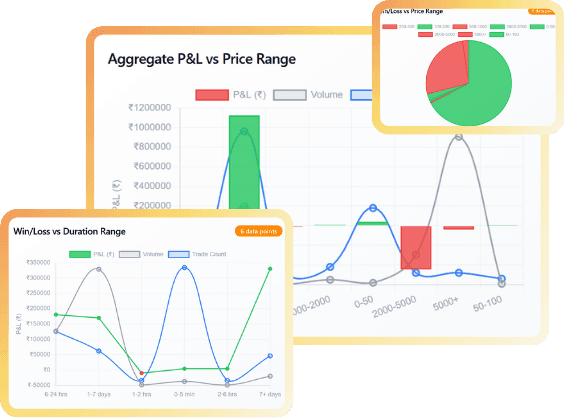

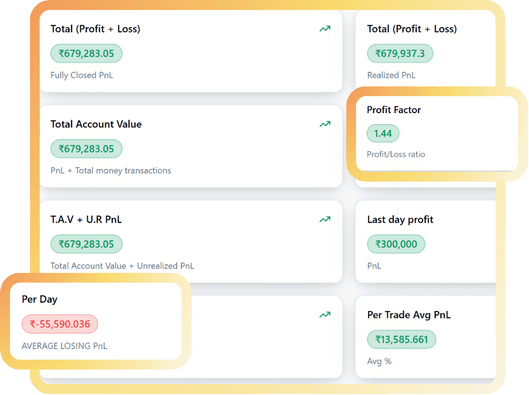

Get complete clarity on your trading performance. With detailed reports, AI analytics, and dynamic visual dashboards, TradeLyser helps you uncover what’s working, what’s not, and where your true potential lies.